Give 1-to-1 money advice to every employee

77% of your employees bring money worries to work.* This makes them less engaged and more likely to seek another job.

As well as access to a powerful tech platform, we match every employee with a real human to help them shed the stress and make their money go further.

Your first employee is free!

Ask about our no-obligation trial.

Join 200,000 employees WHO ALREADY HAVE access to Octopus Money

In uncertain economic times, your employees’ financial health is business critical.

1 in 3

employees are unhappy with their last pay rise1

66%

of employees don’t think their company cares about their personal finances2

73%

of employees say they’d be attracted to another employer that cares more about their financial wellbeing3

How it works

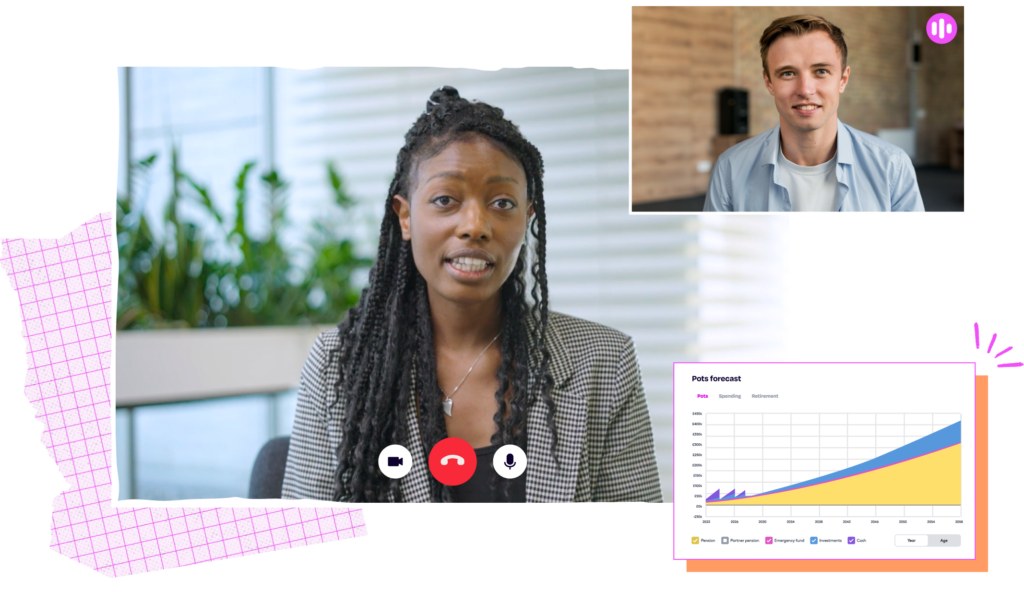

Employees meet with their own money expert

Everyone, across all levels, gets matched with their own coach or adviser for free, confidential video sessions.

They discuss employees’ financial goals. They explain the total rewards package your company offers. And they stay in contact for whenever money questions come up.

It’s chat – without the bots.

They create a personalised plan and forecast

Give employees access to powerful tools to help them make better money decisions.

They’ll create an interactive financial forecast – to help them visualise the long-term impact of decisions today.

They’ll get a specific action plan for whatever they’re saving for.

Did you know employees who have a plan are 5x more likely to feel positively about their future?4

We help you provide comprehensive support on all things money

Pension Advice

Make sure employees are making the most of your workplace pension and on track for retirement

Benefits Guidance

Make sure employees are taking full advantage of all the benefits and perks you invest in

Mortgage Advice

Give employees free support from a mortgage specialist (worth £500 per employee)

Budgeting Support

Help employees feel more in control of their money with 1-to-1 help creating a household budget

Will-Writing

Pass on discounts on personal will-writing, checked by fully qualified solicitors

Webinars & Content

Share access to our digital learning hub with live webinars, articles, guides and more

Trusted by employers to retain their top talent

LEARN MORE ABOUT OUR IMPACT IN:

9 in 10 employees want someone to talk to about money

Hear why “talking to a real person” gives employees financial peace of mind.5

When you launch Octopus Money…

IMPROVE ENGAGEMENT

Up to

60%

of employees will sign up

HAPPIER EMPLOYEES

85%

of employees make better use of their money (save more, reduce their debt, increase their pension)6

LONG-TERM BENEFITS

Employees retire

£289,320

wealthier, on average, thanks to better pension planning6

Monthly insights for people leaders

Thought-provoking perspectives and trends from our team of consultants and coaches.

Frequently Asked Questions

What are the most popular features of Octopus Money?

For employees, the most popular features from Octopus Money are the ability to:

- Get a visualised year-by-year forecast, all the way to retirement, so employees can be confident making bigger financial decisions

- Find out how much to save, invest and put into pension to reach your goals

- Keep track of the money actions you agree with your coach

- Add your partner’s finances at no additional cost

Are you FCA-regulated?

Yes.

However, our money coaches will not provide regulated “financial advice” to your employees. For example, they will never recommend specific investment products or funds to your employees. Instead, they will offer impartial guidance and education, helping employees understand the pros and cons of different options so they can make more informed decisions.

Some employees with more complex circumstances can choose to meet with a regulated financial adviser from our team and receive regulated financial advice.

Why do your costs qualify for tax-efficient salary sacrifice?

In 2017, a bill was passed allowing an employee to receive up to £500 p.a. of ‘pension advice’ as a non-taxable benefit. Every employee that works with a coach or adviser to “Plan Their Goals” will get a personalised retirement plan to help them make better decisions about their pensions. You can read more on our approach to pension advice here. And here’s the full details of EIM21803.

How is Octopus Money different from other financial wellbeing providers?

Take our word for it…”money advice for everyone” is hard to do properly. We have been built from the ground up to do just that – delivering the very best 1-to-1 support for all of your employees, at the best price possible.

- We’re proud to be one of the first and most established providers of money coaching and other financial wellbeing services in the UK.

- We’re FCA-registered for Financial Advice, an Associate Firm of the Personal Finance Society and recognised by the Initiative for Financial Wellbeing.

- We’re building the UK’s biggest and most diverse community of accredited coaches, which allows us to support companies big and small.

- Our team uses professional-grade planning tools to build a personalised plan and action list for every client.

- We take direct and ongoing responsibility for training, supervising and monitoring all of our team – that means clients aren’t passed on to an unknown parties for support.

- Finally, you can trust that we have long-term stability and backing because we’re part of Octopus Group.

How much does it cost?

The cost of the service depends on a few factors, especially the uptake you want to see from your employees. But we offer options for all budgets.

Get in touch with our teams and they can share a custom quote for your business.

SOURCES

*Office for National Statistics, June 2022

(01) 1st Formations Research, 2023

(02) Octopus Money Research, n=4,000, May 2023

(03) PwC, Employee Financial Wellness Survey, 2023

(04) Octopus Money Research, n=1,000, 2021

(05) PwC, Employee Financial Wellness Survey, 2021

(06) These figures reflects the average employee we work with – age of 37 and retirement age of 68 – and the average recommended improvements we’ve made across all of our clients.